In our previous article, “From Data to Decision: The Evolution of Business Intelligence”, we discussed how modern businesses have harnessed the power of data to drive informed decisions. As businesses evolve, the next natural step in this progression is decision automation.

This article will take a closer look into Decision Model and Notation (DMN) as an enabler of automating decision-making processes, building on the role of business intelligence (BI) and workflow automation tools.

The Foundation: Formalising Decision Logic with DMN

In business today, decisions are no longer necessarily confined to boardrooms or manual interventions. Increasingly, companies are looking to automate decisions—whether it’s approving loans, managing supply chains, or assessing customer risk—using formal models that can be executed by machines. This is where DMN steps in.

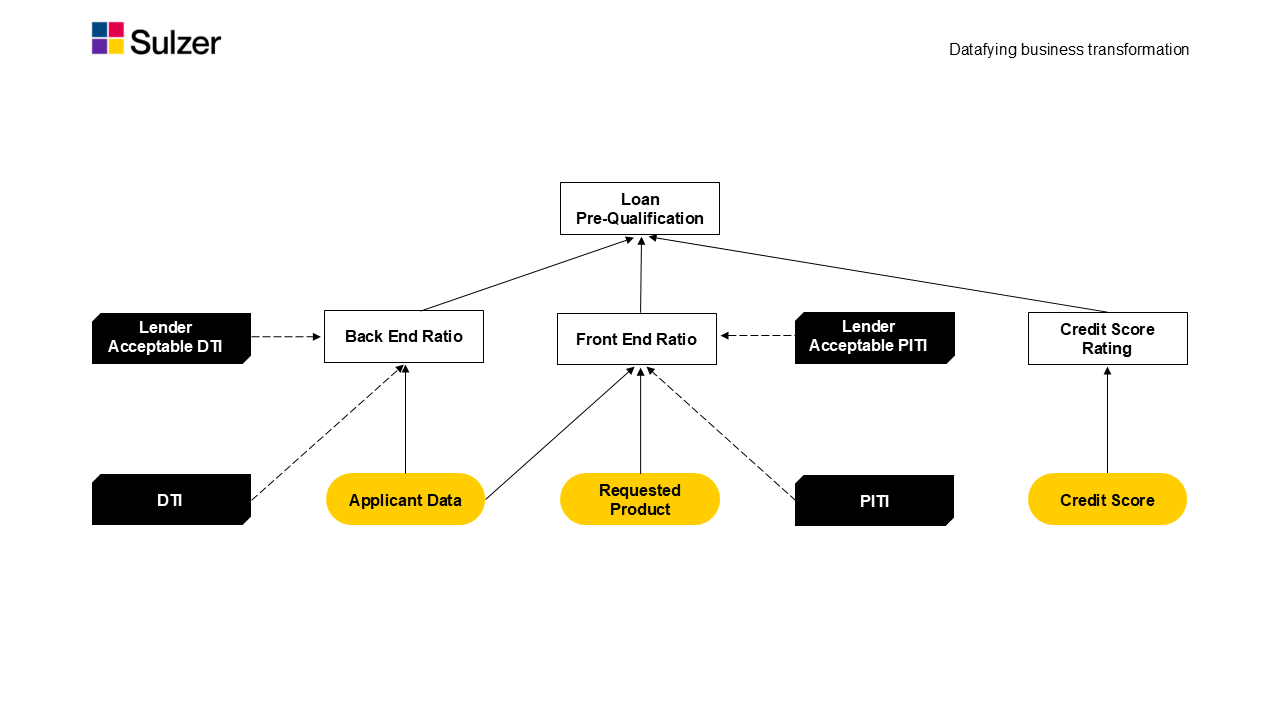

DMN provides a formal, descriptive and structured way to model decision-making. At its core, DMN allows businesses to separate decision logic from workflow processes, ensuring decisions are transparent, traceable, and aligned with business objectives. The logic is codified into decision tables or decision requirements diagrams, which machines can then use to automatically make decisions based on real-time data inputs.

Figure 1 – A decision requirement graph (source https://www.drools.org/learn/dmn.html)

An example: Loan Approval Process

To put this into context, let’s consider a typical loan approval process where DMN is used to define the decision rules. The system evaluates a customer’s credit score and debt-to-income ratio, and the decision table could be defined as follows:

- Approve the loan if the credit score is above 700 and debt-to-income ratio is below 40%.

- Reject the loan if the credit score is below 600.

- Manual Review for scores between 600 and 700, requiring additional checks.

The logic would be expressed in a DMN decision table, making decision-making more automatic, more consistent, and auditable. The rules can be precisely coded using FEEL (Friendly Enough Expression Language), which is designed for decision automation.

Example of decision logic expressed in “FEEL”:

|

if creditScore >= 700 and debtToIncome <= 40 then “Approve” else if creditScore >= 600 and creditScore < 700 then “Manual Review” else “Reject” |

This provides a formalised, machine-readable framework for automating loan approvals with creditScore being a potentially complex interpretation of a multitude of factors on groups and individual (and/or historical) data.

Frameworks for DMN and FEEL

Several platforms, many open-source, support the interpretation and execution of DMN and FEEL logic. These platforms ensure the DMN decision tables and rules are processed accurately by machines. Here some examples:

Camunda: An open-source platform for process automation, Camunda supports DMN and FEEL, enabling real-time decision-making integrated with BPMN workflows.

Red Hat Decision Manager: Provides a DMN decision engine with FEEL support, integrated into the broader Red Hat ecosystem for automation.

Trisotech: A comprehensive digital automation platform that supports DMN and FEEL, offering tools to model and execute business decisions.

Drools: Drools is a rule engine that supports DMN and FEEL, allowing for rule-based automation within business processes.

OpenRules: Another platform that offers robust decision management capabilities, including DMN and FEEL, aimed at simplifying decision automation for users.

These frameworks enable DMN decision logic to be automatically interpreted and executed in real-time environments, supporting process and decision automation at scale.

Integrating DMN with BPMN: Complete Process Automation

While DMN formalises decision logic, it works great when integrated with BPMN (Business Process Model and Notation) to drive full process automation. BPMN models the workflow — how tasks flow from one to another — while DMN handles the decision logic that guides these tasks.

In our example loan approval process, BPMN models the overall workflow: from a customer submitting an application to the bank performing initial screenings and, eventually, making a decision. At the critical decision point, BPMN invokes a DMN model to automatically assess whether the loan should be approved, rejected, or sent for manual review based on the defined rules.

This division of responsibilities between BPMN and DMN allows businesses to streamline processes while ensuring that every decision is based on well-structured, consistent rules. It also adds flexibility: if the business needs to modify decision rules (such as adjusting credit score thresholds), it can do so in the DMN model without altering the overall BPMN workflow. It also allows to think in terms like “decision as a service” which includes concepts of “central decision repositories” and distributed decision making.

Figure 2 – Integration of BPMS and DNM – Source https://www.drools.org/learn/dmn.html

Actionable Decision Automation: The role of Business Intelligence platforms

The next leap in decision automation is “rapid, actionable decision-making”. With up-to-date data together with potentially large historical context windows, decision models can use the data and information available there, respectively data and insights play an important role in defining decision models. BI platforms are capable of analysing historical and real-time data, producing insights that can feed directly into DMN-based decisions.

For example, in a retail scenario, a BI system might detect that sales in a particular region are lower than expected. The DMN decision model can then automatically decide to launch a localised marketing campaign or adjust product inventories to respond to the dip in demand. It would then trigger the appropriate actions — whether notifying the marketing team or adjusting inventory levels based on the decision made by the DMN logic.

This feedback loop between actionable BI insights and automated decisions ensures that businesses can respond to changes in the market quickly, with fewer manual interventions.

Data Management and Governance: The Foundation of Automation

For decision automation to be reliable, businesses need to ensure that the data surrounding DMN models is of high quality. Poor data quality can lead to no surprise to incorrect decisions, undermining the entire automation process. Therefore, data governance and data quality control become essential to maintain the integrity of the data flowing through these decision models.

Data governance ensures that data is accurate, timely, and compliant with regulatory standards.

In this context, platforms like SAP Signavio offer tools for business process optimisation and decision automation, helping ensure that decisions are not just well defined rules frameworks and automated but also built on trusted, well-governed data.

SAP Signavio’s Early Insights into Decision Management

Interestingly, SAP Signavio — a leader in business process management and process mining solutions — already emphasised the importance of business decision management as early as 2020 and updated in 2024 how businesses can leverage decision automation to gain a competitive edge. The article[1] highlights that decision automation doesn’t just streamline workflows but also ensures that decisions are aligned with data governance and compliance requirements, a critical need in industries like finance and healthcare.

SAP Signavio argued that DMN makes it possible to enforce decisions that can be traced back and validated, ensuring compliance with regulations like GDPR or financial audit requirements. The ability to audit decisions has become a key point of DMN, especially as businesses face increasing regulatory scrutiny. Additionally, and as shown before, there are additonal software platforms, which make use and address DMN rules and automate decisions based on formal logic.

More details for the interested reader on how SAP Signavio interprets and makes use of DMN can be found in this learning journey of SAP: https://learning.sap.com/learning-journeys/design-business-processes-with-sap-signavio-solutions/introducing-decision-modeling-notation-dmn-_ef489705-f09f-4e81-9c77-970163340bd6 and following sections or on our website.

Conclusion: The Future of Decision Automation

As hopefully shown, decision formalization and later automation through DMN is of much interest. By integrating DMN with analytical platforms and BPMN workflows, businesses can automate not just the mundane, repetitive tasks but also consider taking automated decision-making processes to higher levels.

This shift from manual to automated decision-making represents the next stage of intelligent processes. While my first article outlined possibilities for using data to make more formalised decisions, this article has explored how businesses can go one step further: thinking in automating those decisions based on structured, formal models that are transparent, consistent, and compliant.

As platforms like SAP Signavio have already shown, the future of business is not just in data-driven decisions, but in auditable and automated data-driven decisions.

Author: Philipp Nell, Solution Architect Data Management and AI, Sulzer España, October 2024

Want to know more?

Get in touch wiht our Experts!